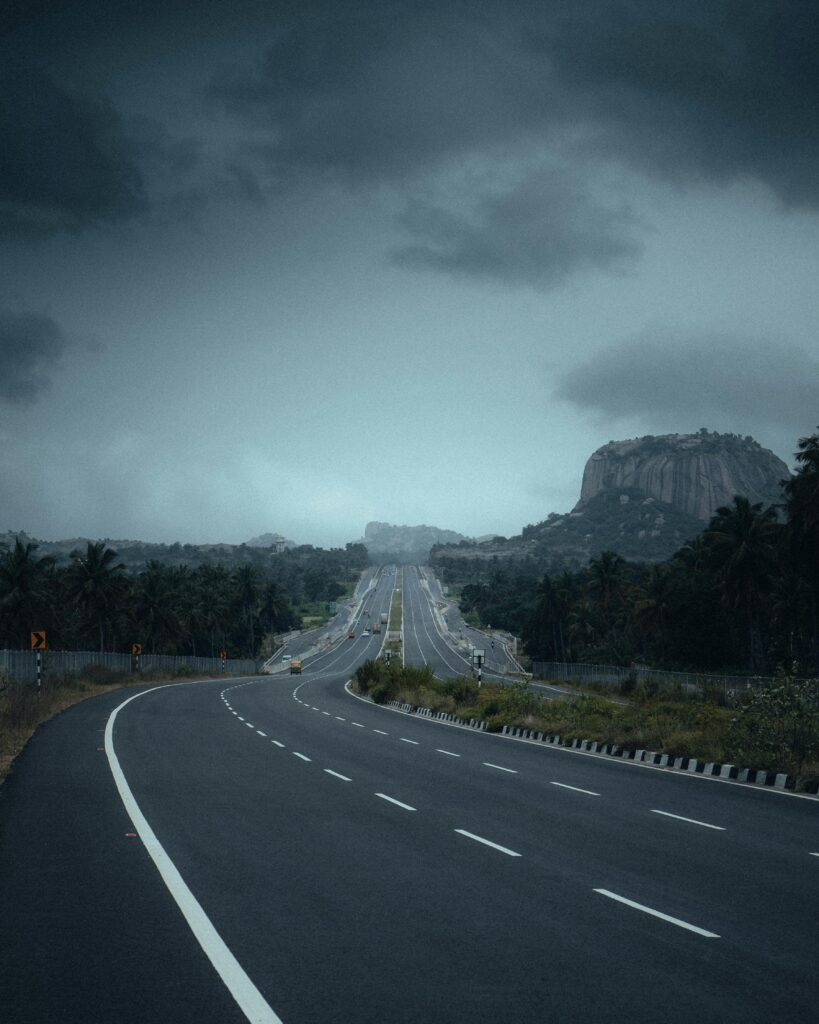

How Lendly Helped an NRI Secure loan for a plot Beside a Highway

Buying land in India can be a complex process-especially for NRIs dealing with urgent timelines, incomplete documentation, and unclear communication from banks. Here’s how Lendly stepped in to help Kumar, an NRI, finance a 1150 sq. yard plot near Vijayawada’s Inner Ring Road despite multiple challenges and rejections. Client Snapshot: Challenges Faced: Kumar faced several […]

How Lendly Helped an NRI Secure loan for a plot Beside a Highway Read More »