Buying land in India can be a complex process-especially for NRIs dealing with urgent timelines, incomplete documentation, and unclear communication from banks. Here’s how Lendly stepped in to help Kumar, an NRI, finance a 1150 sq. yard plot near Vijayawada’s Inner Ring Road despite multiple challenges and rejections.

Client Snapshot:

- Client: Kumar (NRI)

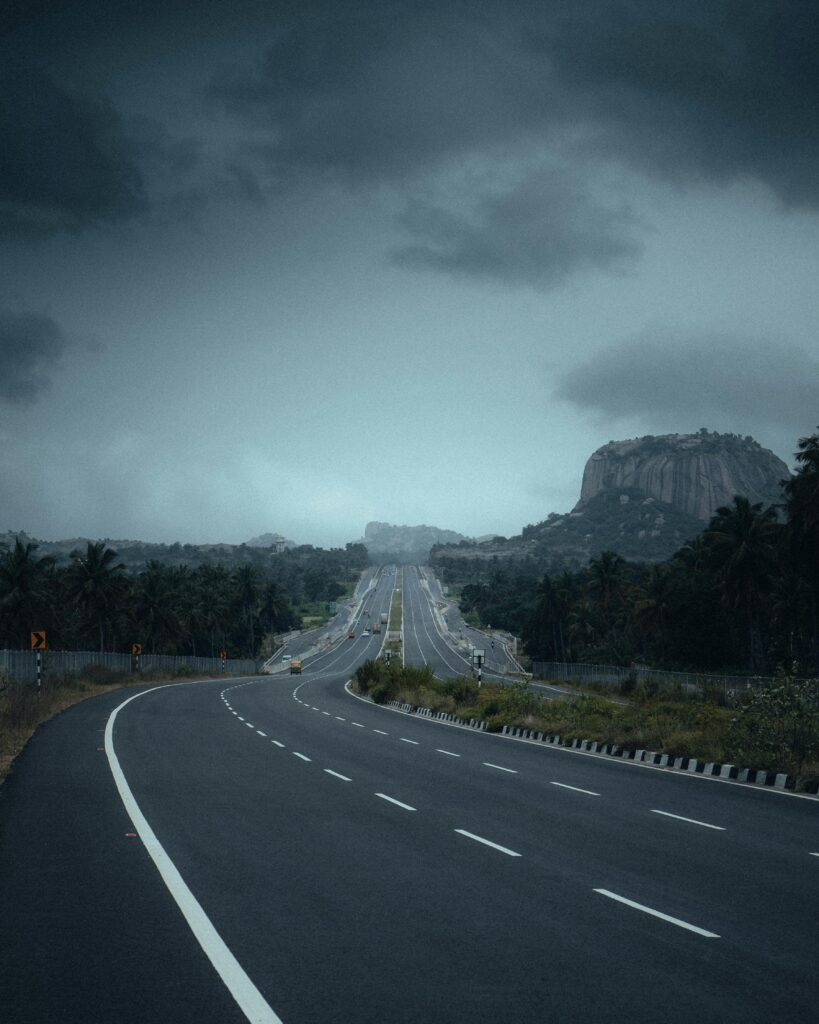

- Location: Vijayawada

- Property: 1150 sq. yards vacant land beside Inner Ring Road

- Loan Requirement: Land purchase financing

- Urgency: Client was flying back to the USA within a week

Challenges Faced:

Kumar faced several obstacles that threatened to derail the transaction:

- No Vacant Land Tax Receipt: Missing key document required for verification

- Faded Family Member Certificate: Legal document appeared fabricated and triggered lender concerns

- Urgent GPA Requirement: Client needed to appoint a Power of Attorney before international travel

- No Security Cheques: Initially unavailable for loan processing

- Bank Rejections:

- HDFC and ICICI rejected the file, classifying the plot as commercial due to its proximity to a highway

- Axis Bank initially promised approval, prompting the client to enter a Sale Agreement, but later declined due to “lack of development”

How Lendly Took Charge:

Lendly stepped in with a structured and proactive approach:

- Identified a Willing Lender: Approached PNB Housing Finance Limited (PNBHFL) and arranged a site visit before file login

- Presented Ground Reality: Highlighted active development nearby-apartments, shops, and commercial godowns-to strengthen eligibility

- Resolved Documentation Gaps:

- Used a Surveyor Sketch as an alternative to the missing Vacant Land Tax receipt

- Released a Public Advertisement to address concerns around the Family Certificate

- Activated an existing GPA in the client’s uncle’s name, making him the acting representative

- Instructed Kumar to issue security cheques from his bank branch, with delivery updated to the GPA address

- Negotiated Loan Terms: Secured a 0.75% interest concession, bringing the final ROI down to 9.25%

Outcome: Fast, Favorable Loan Sanction

Lendly secured full financing for Kumar’s land purchase before his scheduled international departure. We avoided a potential CIBIL hit, protected his Sale Agreement, and ensured a smooth disbursement-all within days.

Why Choose Lendly?

This is just one example of how unpredictable the home loan process can be-even for experienced customers. When banks reverse their stance or overlook a detail, it can lead to major setbacks. Lendly provides speed, accuracy, and smart solutions-especially in high-stakes situations.

Get expert help for your land or property loan-contact Lendly today!